Singapore continues to attract foreign investors with its political stability, robust legal system and ease of doing business. Thanks to these three factors, the property market will continue to exhibit resilience. However, the real estate investment landscape in Singapore does require patience with the focus on a long-term return, especially with the uncertainties and headwinds in 2024. Hence, it is paramount to keep a close watch on the following five real estate trends.

Environment, Social and Governance (ESG)

The Singapore Government, through the Government projects authority, is encouraging construction companies to build greener buildings by incorporating ESG requirements in tender, such as attaining the Green Mark Certification. With these new ESG requirements, higher construction costs are inevitably expected which may drive the prices for the properties up in the long term. Despite the higher price, the demand for eco-friendly properties is on the rise. Business and home owners are increasingly seeking properties which align with their values, promote sustainability and healthy living, and offer long-term cost savings.

Property Tax for Residential Property

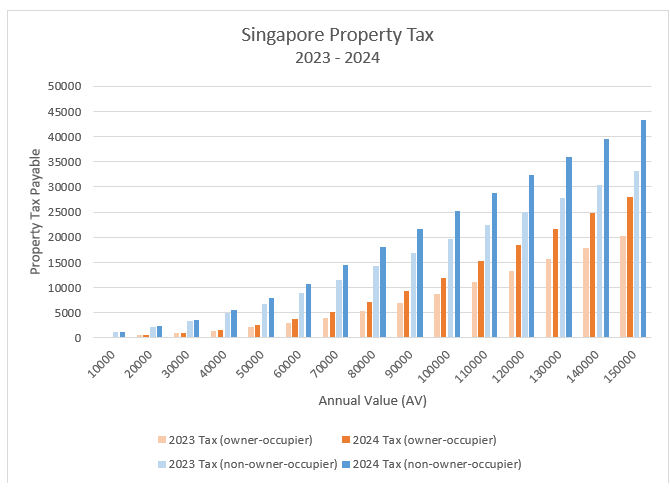

The annual values of Housing Development Board (HDB) flats and most private residential properties increased with effect from Jan 1, 2024 to reflect the rise in market rents. Those with higher valued properties will experience greater impact from the increased property taxes, in particular those who are non-owner occupied properties.

The following Graph 1 – Singapore Property Tax provides an indication of how the new 2024 rates compare to the 2023 rates for both owner-occupied and non-owner-occupied properties. Evidently, non-owner-occupied homes are hit the hardest with the rate increase, particularly those with a higher annual value. For example, where a non-owner-occupied property has an annual value of $50,000, there is an increase of $1250 per year, or an additional $104 per month (annual property tax payable of $6750 in 2023 compared to $8000 in 2024).

Interest Rates

For 2024, the Monetary Authority of Singapore expects overall inflation to average between 3 to 4 per cent, while core inflation is expected to average 2.5 to 3.5%. This is down from 2023’s official forecast of headline inflation of around 5% and core inflation of around 4%.

With the US expected to cut the Federal Reserve’s rates in 2024 after aggressively hiking interest rates since March 2022, Singapore banks are also expecting a fall in the three-month compounded Singapore overnight average rate (Sora) next year — a benchmark for various loans. United Oversea Bank (UOB) is projecting the three-month Sora to fall from 3.75% on Nov 30, 2023, to 3.72% by the first quarter of 2024, and to 3.28% by the last quarter of the year.

Working from Home

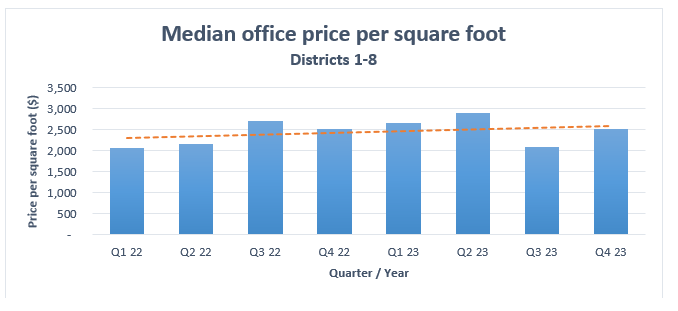

According to media reports, Singaporeans are still preferring a hybrid work environment. However, we can see that employers are expecting the employees to return to the office in 2024. The debate as to whether organisations will return to the office fully or maintain hybrid or remote working models is still ongoing. In Singapore, commercial real estate is already seeing an uptick in the past 8 quarters. Refer to the following Graph 2 – Median Office Price Per Square Foot. These pockets of decline are expected to be temporary due to changing views of ‘work from home’ arrangements. Generally, businesses in Singapore (including government departments) are moving back to a full or hybrid working model, and the post-pandemic recovery has also seen commercial projects get back on track.

Anti-money Laundering

Following one of Singapore’s biggest cases of suspected money laundering in which the value of assets seized was more than USD 2 billion, luxury property transactions reduced in the last quarter of 2023. Sellers, landlords and agents are turning cautious and employing more rigorous background checks – and in some cases have actively turned down deals from prospective clients.

Coincidentally, on 28 June 2023, the Singapore Government introduced a new anti-money laundering and anti-terrorism financing measure. Developers are now required to perform risk analyses, carry out customer due diligence (CDD) measures, report suspicious transactions, and keep records for five years. This new requirement has no doubt increased the cost of compliance, having a greater impact on smaller Developers as their lower volume of transactions may not support the requirement for such additional resources.

In summary, while there are changes that affect the real estate market in 2024, the property sector is expected to remain resilient in the face of uncertain macroeconomic factors due to Singapore’s strong rule of law, stable political environment, and our openness to foreign investment.